Disney Stock News : Despite the challenges, we think the market is too pessimistic about Disney stock.

Important Morningstar KPIs for The Walt Disney Corporation

- Fair value estimate: $145.00

- Morningstar Rating: 5 stars

- Morningstar Economic Mot Rating: Huge

- Morningstar Uncertainty Rating: High

What we thought about Disney earnings – Disney Stock News

Disney’s DIS fiscal fourth quarter showcased the firm’s financial strength and why we think the stock is undervalued despite the challenges it faces. Most notably, the firm has cut costs significantly, with free cash flow skyrocketing. Still, TV-related issues persist, and the attention-grabbing 7 million new streaming subscribers indicated very little domestic growth. We question how Disney can successfully funnel its shrinking linear business directly into its direct-to-consumer streaming offerings, but to pull such valuable franchises and levers, we think the market is too pessimistic. Our estimate of $145 fair value is upheld.

Also Read:- Hootie And the Blowfish Tour to Stop at Somerset

Profit and free cash flow were the stories of the quarter in our view. Total segments’ operating income increased 86% year over year, driven largely by a $1 billion improvement in the Experiences segment and DTC losses. The company continues to project that streaming services will turn a profit by the end of the 2024 fiscal year. Disney plans to spend $7.5 billion a year on its operations by 2024. The company anticipates $8 billion in capital investment, despite intentions to raise it by roughly $1 billion. In free cash flow in 2024, over $5 billion in 2023.

Subscriber gains fuel Disney international growth

Disney Stock News – In addition to experiences, sales growth was not inevitable. Fourth-quarter entertainment revenue rose 2% year-over-year, with 12% DTC growth more than offsetting a 9% decline in linear network sales and slight declines in content sales and licensing. Like its peers, advertising on the linear network was weak. However, affiliate revenues were also low despite higher rates, and we do not see significant improvement in either of these revenue streams as long as pay-TV subscribers and linear viewership continue to decline.

Sales growth at DTC was almost entirely due to a jump in international subscribers, as average revenue per subscriber across all services was little changed, and the subscriber base for domestic Disney+ has remained flat over the past year.

In the quarter, Disney+ added 500,000 domestic subscribers and nearly 6.5 million international subscribers in a year, while Disney+ added nearly 10 million subscribers. Now that the firm will own 100% of Hulu, it wants to offer a merged Disney+/Hulu app experience. With the eventual addition of ESPN to the DTC offering, we expect significant growth in both subscribers and monetization.

Sports revenue was almost flat year-over-year, which we see as encouraging given the challenges linear networks are facing. ESPN+, which attracted 800,000 subscribers in the quarter and nearly 2 million over the previous year, was the sole reason for ESPN’s 1% rise.

The Experience segment remains very strong, with sales up 13% and operating margin up 3 percentage points to 21.5%. International parks and domestic cruises were the main sources of growth and management continues to lean towards these segments.

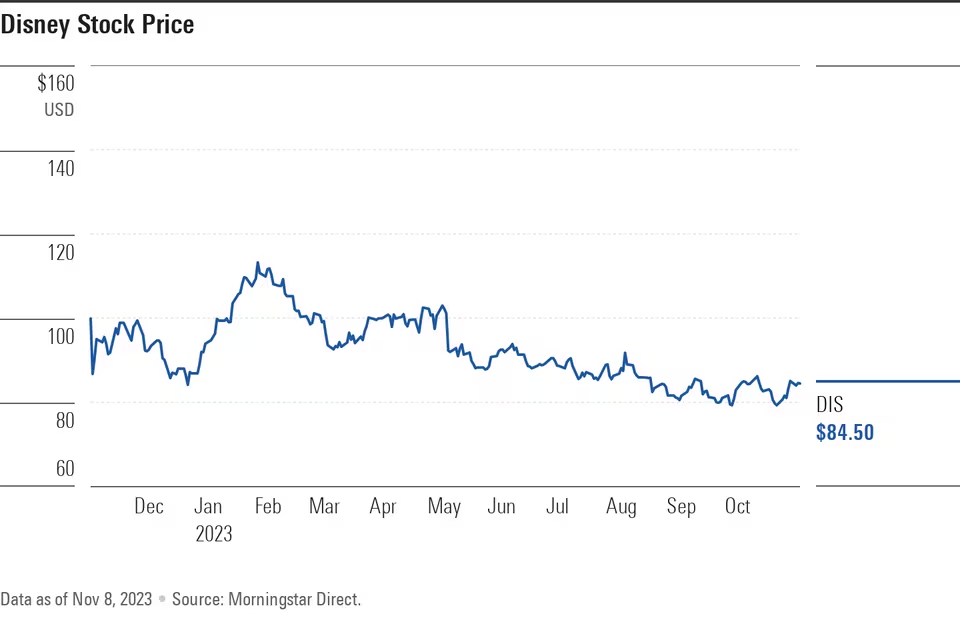

Disney stock price